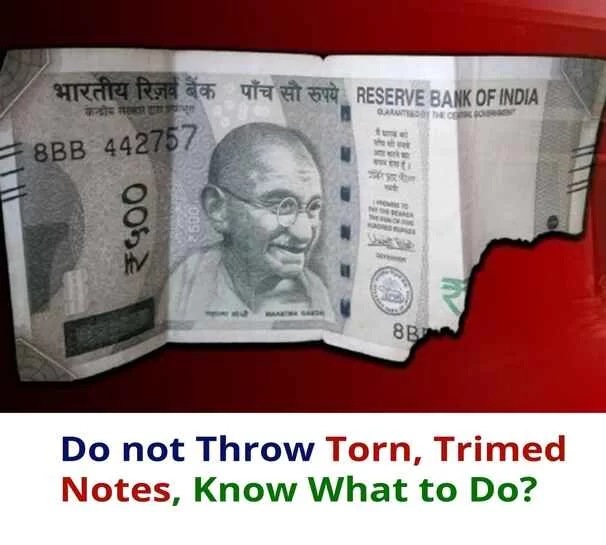

Mutilated Notes: What to do if you have Torn or Damage Notes: What is the RBI Rules? Know inside this story.

Share with social media

Mutilated Note: The worry of mutilated notes is no more; know these new rules regarding exchange of notes.

'The Reserve Bank provides the facility to the public to exchange mutilated and defaced all notes. In order exchange the notes, RBI made the rules easier to understand, these rules have been extensively amended and simplified.

If you have gone to the market to buy vegetables or buy some goods, then on return, you realize that you have accidentally brought a torn note from someone. Now at home you feel sad about what will happen to this note. How will this note work? You also try to give it to a shopkeeper but he interrupts you, Brother, the note is torn or damaged, give me another one. Now you have a problem as what to do? Big Question!

Now days, there is way that you should go to the bank. You are afraid of going on this path that the bank might impose some kind of penalty, or the bank might not answer the questions. Lest you be accused of causing harm to the country's currency... All kinds of questions come to your mind and you cannot find a way out. The bank cannot refuse you. The bank will have to give you the note in exchange.

So, You have very easy option that you can go to any bank near you and ask to exchange the damage notes, RBI has already made such rules. Let us tell you that the Reserve Bank had said in a circular that if other banks refuse to exchange bad notes, then a fine of Rs.10, 000 can be imposed on them. This rule also applies to bank branches. For your information, let us tell you that the Reserve Bank of India (Note Refund) Rules, 2009 has been made a formal law. This has also been made available on the Reserve Bank's site. Every aspect has been considered in detail under this law.

Its preamble states, 'The Reserve Bank provides the facility to the public to exchange mutilated and defaced notes at all its issue offices and currency chest branches of commercial banks. In order to exchange such note, the rules are easier and you need to understand the use, these rules have been extensively amended and simplified.

It has also been decided that any officer of the designated branch can adjudicate the mutilated notes presented in the concerned branch. It is hoped that the simplification and liberalization of the rules will be helpful to both the Designated Officer and the tenderer of the defaced notes in understanding the amended rules and for the Designated Officer to apply it impartially.'

It states that while the facility for exchange of damaged notes is to be provided by all banks in all their branches, the facility for exchange of mutilated notes is to be provided at designated bank branch (including co-operative banks and regional rural banks). ) will be available to all tenderers, whether they have an account in that bank or not. This is a responsibility of the entire banking system as a whole towards the public.

Needless to say, the purpose of simplification and expansion of Reserve Bank of India Note Refund Rules is to assist the general public in exchanging their mutilated notes without any difficulty. The designated bank branches should work proactively and ensure that this facility is provided in general for the benefit of the general public and should not be encroached upon by any group of individuals.

ALSO READ: ![]() Countries Accepting UPI Payments, It can also be used in Sri Lanka and Mauritius

Countries Accepting UPI Payments, It can also be used in Sri Lanka and Mauritius

This manual of RBI includes the rules to be followed and procedure to be adopted under the scheme. The major rules have been updated for quick and easy understanding. The procedure to be followed by the bank branches regarding acceptance, adjudication and payment of mutilated notes is given in the RBI booklet.

From today, investors will be able to bet on the Indegene IPO. Investors will have the opportunity to bet on this IPO until May 8. The Rs 1, 841.76 crore IPO comprises fresh issuance of shares worth up to Rs 750 crore,

Bharti Hexacom IPO: The total size of Bharti Hexacom IPO is Rs 4,275 crore. Through this IPO, the company will sell 7.5 crore shares. You can invest in this IPO from 3 to 5 April.

Explore the SRM Contractors IPO GMP, Lot Size, Price, and Date at PrimeNewsly. There is good news for investors looking at GMP. The SRM Construction IPO will open next week. The company has raised Rs 39 crore from anchor investors.

Gopal Snacks IPO GMP: The IPO of Gopal Snacks has opened for subscription from today. It will remain open till March 11. The company has fixed the price band of the IPO at Rs 381-401 per equity share.