Learn these Tips and Guide: How to Manage Expenses and Save Money at PrimeNewsly. Find out how to manage daily home expenses without feeling overwhelmed or stressed.

Share with social media

Handling money and managing expenses is an art; however, often, people end up making unnecessary purchases and haywire their budget. It is when having the basics of financial literacy and understanding how to manage expenses and save money becomes essential.

For all those who wind up with zero savings by the month’s end, the article will be an eye-opener. Keep reading to upgrade your financial skills and manage personal finances like a pro.

When it comes to managing money, discipline is the key. Start jotting down what you purchase every day and keep its written record. It will help you understand where all the money is going and thus help cut unnecessary expenses.

For instance, even if you pay Rs 50 to buy a packet of chips and juice, write it down. Later, you may feel that it was absolutely unnecessary and unhealthy, too. Make this a habit- continue writing for at least a month and evaluate every needless expenditure.

Now that you know how much you have spent in a month, create a budget based on how much you earn and spend and what can be avoided to save some extra money. A budget can be prepared based on your priorities and goals, and it is how to manage house expenses in India.

For instance, you can’t skip buying groceries and paying the rent or EMIs, but spending excessive amounts on shopping can be avoided. Here, the 50-30-20 rule can be applied wherein you spend 50% of your earnings on needs that include housing, food, clothing, insurance, debt, and taxes, 30% on entertainment and other luxuries, and the remaining 20% on savings. Once you have prepared the budget, stick to it and make sure the 20% savings are not going anywhere.

People in your family might have subscriptions for multiple streaming services, and many of them won’t be using them for so long. It is when cancelling the unnecessary subscriptions or getting their cheaper versions can help. You can always re-subscribe, but keeping it without using it is a waste of money. It is one of the ways on how to manage a home on a low budget.

If you often wonder how to manage daily expenses, saving on utility costs will help tremendously. Utility bills like water, electricity, internet, telephone, etc., come under monthly expenses, and no one can live without them. However, you can find ways to lower the bill’s amount by making some mindful choices.

For instance, replacing regular bulbs with LEDs, unplugging unused electric devices, installing a programmable thermostat for the heating and cooling systems, turning the lights off when not in use, avoiding irrational use of water, etc., can help a lot.

If you live away from home, locating to areas that are less expensive and getting a roommate can help save a huge amount. It is one of the ways how to manage your expenses as a student.

For families, even though having their own house is an asset, renting also offers many benefits. Firstly, monthly rent is often less than the monthly EMI, and secondly, the expense for repairs can be avoided when you live in a rental. Make a good relationship with your landlords, and the home will feel like your own. It is one of the ways how to manage house expenses.

Eating is a necessity, but dining out or ordering from food apps is not. Even though these options seem time-saving and tastier, they are not helping you save enough. In fact, such food choices are digging a hole in your pocket and deteriorating your health, a double loss.

So, even if you are not a master chef of the home, check out the different cookbooks or internet content and learn how to prepare easy meals at home. Buy groceries using coupons or deals and look for nonperishable items more. Also, purchase from local shopkeepers instead of going to branded stores where everything is labeled expensive.

Before heading out for the grocery store, create a list of things you require and stick to it. Once you enter the store, reach out only to the places where your requirements are placed. This way, you will end up buying only the necessary items and not the things that are not on the list. Additionally, resist your temptation to buy something on impulse as it will fail your plan to stick to the list.

Irrespective of how much credit cards seem a blessing in disguise, they are one of the culprits behind your extra expenditure. Credit cards make an expensive purchase look easy as you have the option to pay later when the bill comes. And it is how you end up getting into credit card debt.

So, if you have one, do not take it everywhere you go shopping. Instead, keep it at home and consider freezing, which will make it less convenient for your daily or impulsive expenses.

One of the ways how to reduce expenses in daily life is switching to cash-only payment. Even though it’s not possible all the time, especially during big purchases, try to make it a habit for smaller ones.

Studies have indicated that spending cash makes people mindful of their buying choices. It is because watching money coming out from the wallet and going to the other hand makes one frugal. While utility and bill payments can be made online, ensure the rest are cash payments.

If, even after all these steps, you are not getting how to manage expenses, find different ways to cut the expenditure. Here are the most effective and useful five money-saving ideas that will help you save some extra bucks every month-

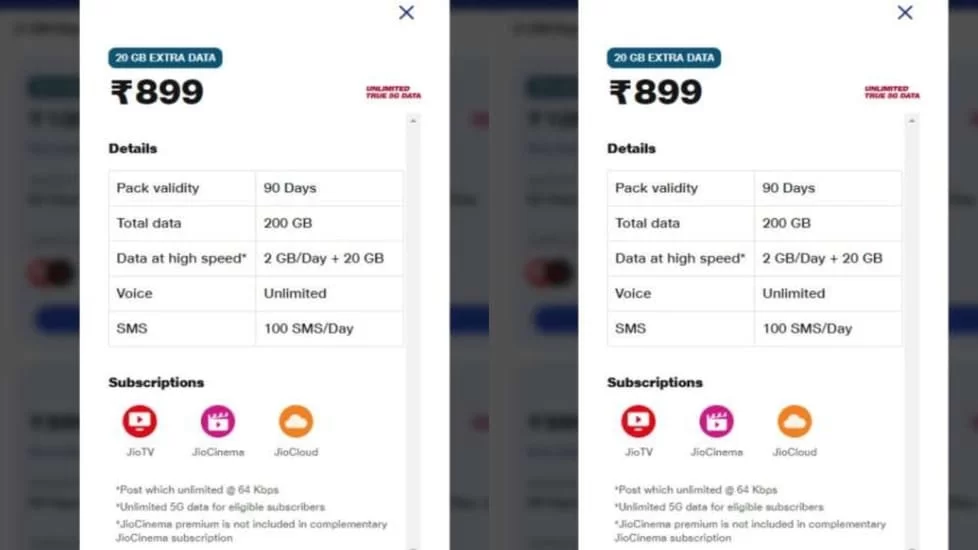

ALSO READ: ![]() Jio's 90 days Plan, 20GB Data Extra with budget Price, Know details

Jio's 90 days Plan, 20GB Data Extra with budget Price, Know details

Spending mindfully and prioritizing the necessities is the basic step toward managing expenses.

It means putting 50% of your money toward needs, 30% toward wants, and 20% toward savings.

Calculate your net income, track your spending, and set realistic goals with the 50-30-20 rule to create your budget.

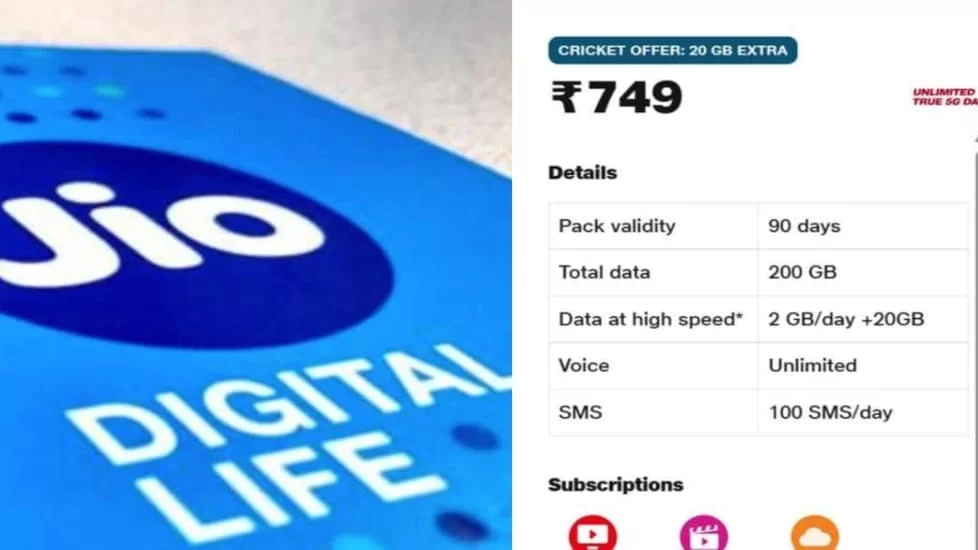

ALSO READ: ![]() What is Jio’s 749 Plan? Check Validity, Data, Free Apps, Other Benefits

What is Jio’s 749 Plan? Check Validity, Data, Free Apps, Other Benefits

Conclusion

Making a few lifestyle changes can work wonders in managing expenses and saving money by the end of every month. So, stay mindful of what and how much you spend monthly. It is one of the best ways to save for the future and stay secure.

Jio's 90 days Plan: Reliance Jio has made a big change in its recharge portfolio. Despite Jio's recharge plans being expensive; there are still some plans that offer great offers at affordable prices. The plan offers 20GB of additional data along with unlimited voice calls.

749 jio plan details and Benefits: Reliance Jio is offering several recharge plans for its prepaid customers. Jio's affordable new prepaid plan is a bundle pack of offers. It offers unlimited data and free calling. Reliance Jio is offering 20GB additional data to its subscribers.

Chaitra Purnima 2024 and Hanuman Jayanti: The first full moon of the Hindu New Year will be celebrated tomorrow. It is called Chaitra Purnima. On this auspicious day, Lord Ganesha and Goddess Lakshmi are worshipped. The festival of Hanuman Jayanti is also celebrated on full moon day during Navratri.

Fan Speed Tips for summer: You first need to know why the speed of the fan goes low in summer. We further explain you that the speed of the fan is low in summer for two reasons. If you know this, half of your problem will be solved.